From Distress to DPI: Rescuing Good Assets from Bad Situations

Price is what you pay. Value is what you get. —Warren Buffett

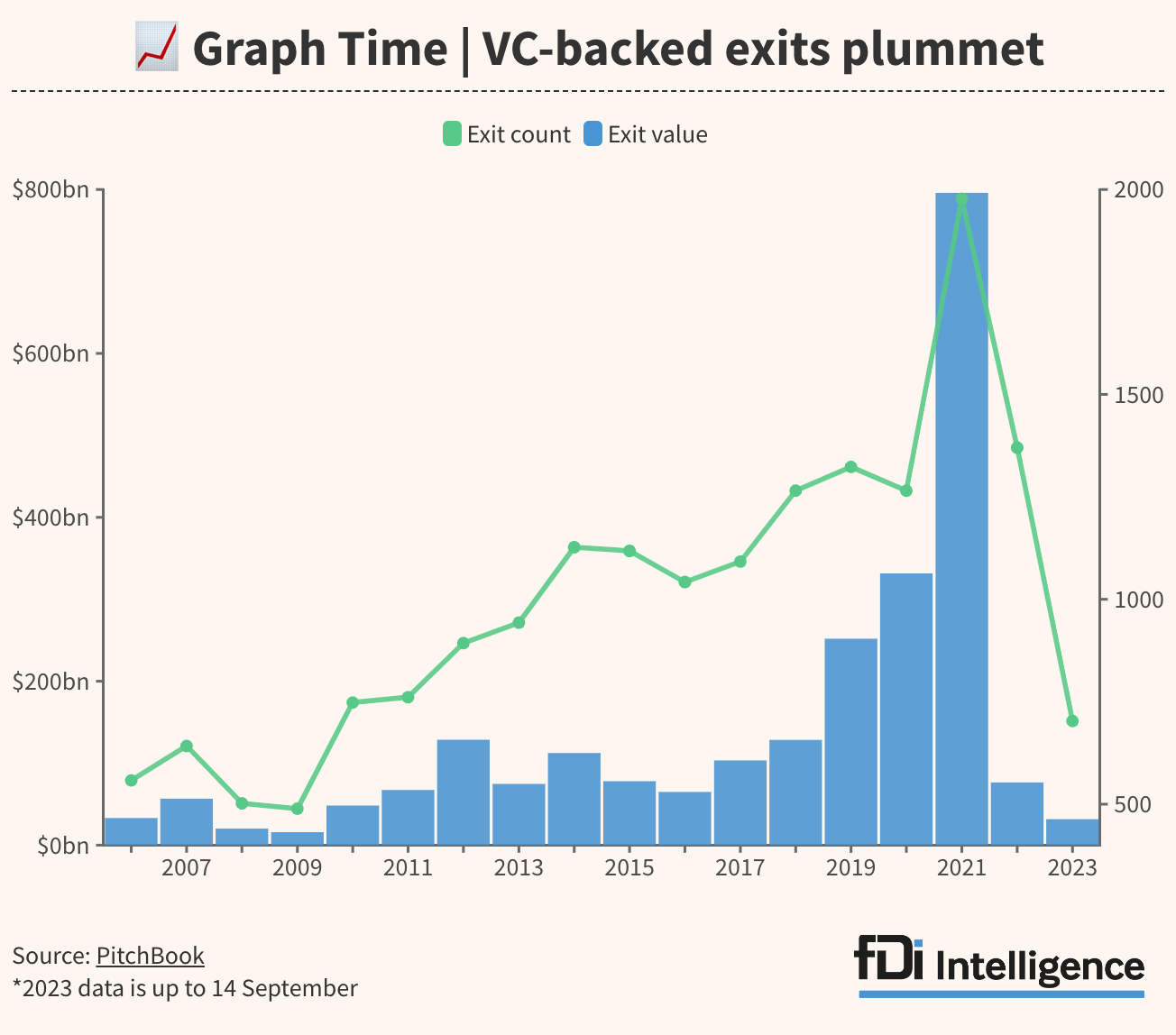

Venture capital is nothing if not an asset class of extremes. It oscillates between booms and busts, home runs and strikeouts. Unfortunately for founders and funders alike, the wells of easy money, sky high valuations, and ample exit opportunities have run dry.

Within this fracas, discerning investors have set their sights on a new opportunity: distressed venture funds. Amidst macroeconomic uncertainty, falling valuations, and industry hurdles, these overlooked—though often solid—assets offer a fresh avenue for investors aiming to boost their returns and diversify their portfolios.

Distressed funds are those venture capital outfits grappling with financial or operational challenges and defaulted/unfulfilled Limited Partner (LP) positions. In a recent Business Insider piece, Ben Bergman explored this phenomenon:

During the middle of 2023, Sara Ledterman, managing partner of 3+ Ventures, was calling around to emerging managers to ask about the health of their portfolios when she discovered something alarming: Some of the limited partners (LPs) who had committed to fund their investments were walking away.

"Some of them just decided there's not really a repercussion for defaulting, so they just defaulted," Ledterman found.

LPs are the pension funds, family offices, and endowments perched atop the now fragile tech hierarchy. When they renege on their commitments, venture firms can't fund startups, which in turn have to lay off staff or go out of business. Venture firms unable to generate good returns will not be able to raise a new fund and will become zombies.

"There's a domino effect across the market," Ledterman said.

As interest rates continue to remain elevated, so too does these funds’ prevalence: Business Insider estimated that 8,538 VCs stopped investing in the last two years.

Worse, according to internal Pitchbook data, 452 of those funds have at least 50% of their committed capital still available as dry powder (signaling they are “open” but are unable to make capital calls or close out their respective fundraises). What’s more: only 21 of those 452 funds have positive IRR performance data.

Warren Buffet had it right: “Only when the tide goes out do you learn who has been swimming naked.”

“We have started seeing big names in VC shutdown, including funds at Blackstone, OpenView, and Foundry, but there is a large, quieter group of emerging funds that are trying to stay under the radar in zombieland,” said Stealth Founder and Overlooked Ventures Founding Partner Brandon Brooks.

This is not new. Venture capital activity saw a significant decline in the last few quarters, with the number of new funds launched dropping from 1,351 to 488. Even more telling, the total value of these funds also plummeted, from $172.8B to $67.3B.

A 2023 Pitchbook report highlighted another interesting trend: about 38% of the 6,500 new venture funds since 2016 have entered a period of inactivity (i.e. no new investments). This situation, while seemingly bleak, represents fertile ground for investment.

Ledterman is taking notice: "Recent years have brought challenges that weigh on the venture ecosystem, but also opportunities for patient and disciplined investors. With over a trillion dollars potentially up for grabs, there’s a case for strategic investment in these funds," she says. Their current fund of funds is primarily allocating to distressed and defaulted LP positions.

The entry of new players in the ecosystem partly explains the proliferation of funds both durable and distressed. Platforms like Carta and AngelList have made it easier for new general partners (GPs) to spin up funds and the low/zero-interest rates of previous years made capital easier to access. These GPs might be adept at sourcing deals but often lack the internal structure required to weather a macroeconomic shift. This has led to an increase in funds that, though distressed, are full of untapped potential.

Investing in distressed funds, especially those three to seven years into their lifecycle, offers a clearer perspective on their potential. This approach allows for a more informed assessment of their potential return on investment. Moreover, these funds often focus on specific sectors and are managed by teams with deep expertise, Hamilton Lane estimated emerging VC/Growth firms outperform the market with 15.1% & 15.8% annualized returns. This specialization can lead to faster, more significant returns compared to more suboptimal, older funds, which according to Pitchbook, Funds 5+ produce significantly lower returns than earlier vintages.

That said, with greater reward comes greater risk—it's important to approach these investments with caution. Conducting thorough research, implementing effective risk management, ensuring liquidity/cash flow, and maintaining a diversified portfolio are crucial. Part of the reason the market is facing so much pressure is due to the over-allocation of dollars into venture capital and the lack of access to liquidity. In 2023, just $66.6 billion was generated through VC-backed exits in North America.

The current high-interest rate cycle presents a unique opportunity for those looking to invest in distressed funds. Per Nathan Rothschild, “the time to buy is when there's blood in the streets,” many funds across the US are positively gushing.

By investing in distressed funds later in their lifecycle, investors can bypass the J-Curve and take advantage of the purely upward trajectory. Investors who explore this new frontier will reap substantial rewards as bust reverts back to boom over time.

Disclaimer: This article does not constitute financial advice. Always consult a licensed financial advisor before making any and all investment decisions.